Summary:

This guide explores 2025 ruby market trends, premium pricing over $1M per carat, global sources including Mozambique, Madagascar, Vietnam, Kenya, and Tanzania, and ethical buying practices. Learn how to evaluate color, clarity, carat weight, and origin while considering investment strategies and synthetic alternatives.

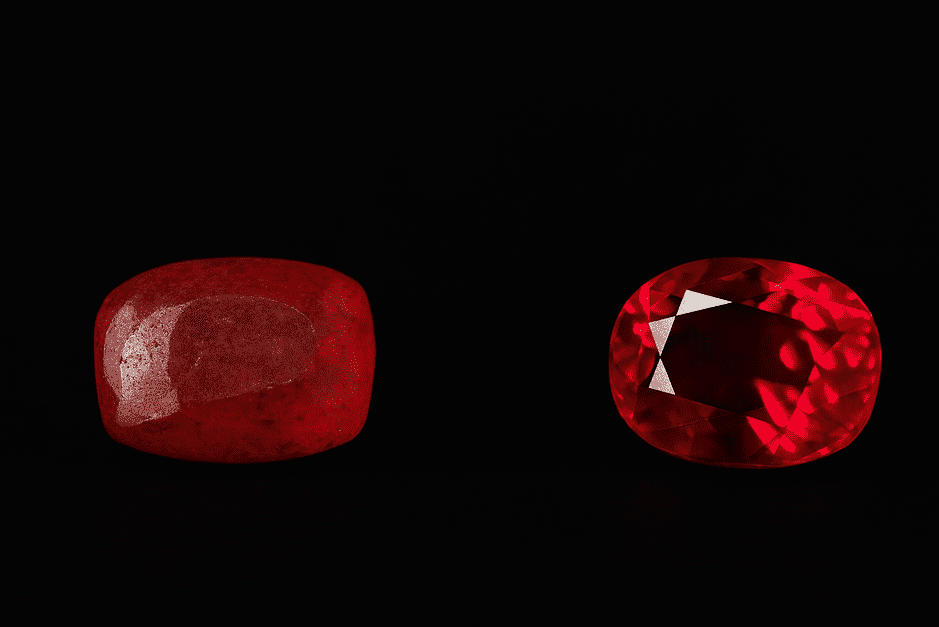

Ruby remains one of the world’s most coveted gemstones. In 2025, premium rubies reach prices over $1,000,000 per carat, while average sales across all qualities hover at $461.48 per carat. Collectors and investors must assess color, clarity, carat, and origin for successful purchases. For example, the GIA Ruby Grading Guide helps evaluate color and clarity.

Market Value Drivers

- Color Intensity: Vivid red, especially pigeon blood from Myanmar, commands the highest premiums.

- Clarity: Eye-clean rubies outperform those with visible inclusions.

- Carat Weight: Larger stones increase exponentially in value.

- Geographic Origin: Myanmar leads, Mozambique competes, and certification affects investment potential. Additionally, Mozambique production reports show consistent quality, making it a strong alternative source (Mozambique Mining Reports).

Natural rubies are scarce, and untreated stones often appreciate faster than heat-treated alternatives. Consequently, scarcity and rising collector demand drive prices upward.

Cultural and Psychological Appeal

Rubies carry historical significance across civilizations:

- Ancient warriors wore them for protection.

- Royalty displayed them for authority.

- Modern buyers seek status, emotional connection, and investment diversification. Moreover, rubies trigger psychological responses connected to passion and vitality.

Ethical Sourcing & Conflict Ruby Concerns

Myanmar rubies may finance military operations, making traceability critical. Therefore, consumers should:

- Request origin documentation

- Verify third-party certifications

- Support conflict-free alternatives

For instance, see our Gold Buying Checklist for Malayalis for ethical buying guidance.

Major jewelry brands are investing in transparency, but supply chain gaps remain. Furthermore, awareness among buyers can drive positive industry change.

Global Ruby Sources

- Mozambique: Largest producer (1.3M carats in 2023), mechanized mining, investment-grade stones.

- Madagascar: Artisanal mining, natural brilliance, environmental challenges.

- Vietnam: Alluvial deposits, commercial jewelry market focus.

- Kenya: Emerging high-quality sources with limited mechanization.

- Tanzania: Small-scale regional production. Similarly, African sources are gaining recognition as Myanmar supplies face ethical scrutiny.

Synthetic Ruby Market

Projected to reach $6.45 billion by 2029, synthetic rubies offer ethical sourcing, consistent quality, and lower environmental impact. Thus, they appeal to younger buyers and ethical investors.

Investment & Buying Framework

- Verify origin and treatment

- Balance natural scarcity vs. synthetic alternatives

- Consider long-term value, cultural significance, and collector premiums

Ultimately, your purchasing decisions influence global ruby markets and ethical practices.

FAQ

Q1: Are rubies over $1M per carat real?

Yes, top-quality pigeon blood rubies from Myanmar can reach these prices at auctions. Indeed, auction records confirm this trend.

Q2: How can I verify ethical sourcing?

Request detailed origin documentation, third-party certifications, and support conflict-free retailers. Additionally, ask about community benefit programs.

Q3: Are synthetic rubies a good alternative?

Yes, they offer identical optical properties, ethical sourcing, and affordability. Moreover, they reduce environmental impact.

Q4: Which countries produce the highest-quality rubies?

Myanmar leads, followed by Mozambique and Madagascar for investment-grade stones. Similarly, Kenya and Tanzania are emerging sources with growing recognition.