Summary:

Gold savings schemes in Tamil Nadu help buyers save systematically for jewellery purchases. This guide explains how these plans work, their benefits, hidden conditions, and whether they are worth joining. Learn the real cost and compare with other investment options.

Introduction

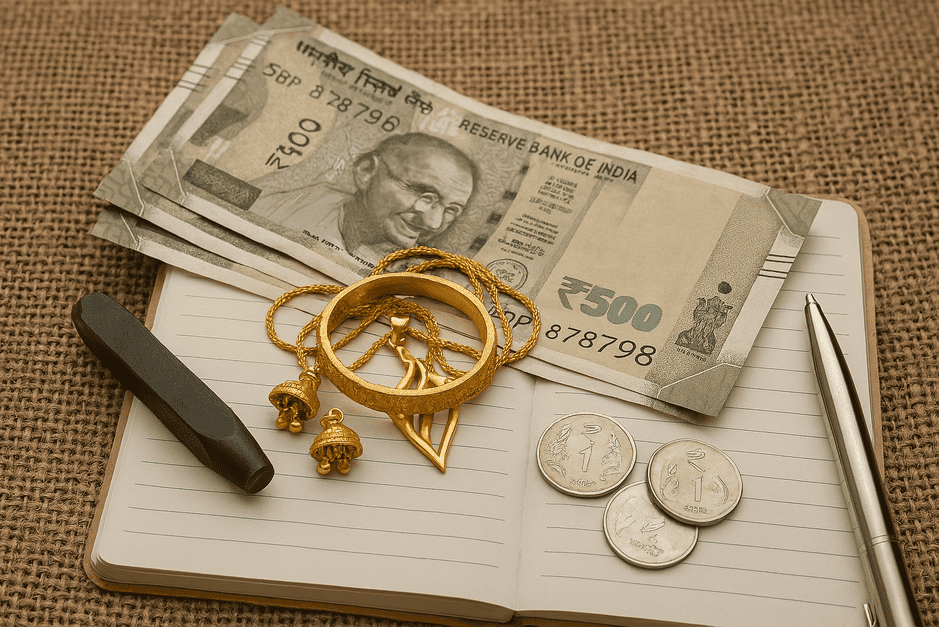

Gold is an integral part of Tamil Nadu’s culture, especially during weddings and festivals. Interestingly, many jewellers now offer gold savings schemes to help buyers accumulate funds for future jewellery purchases. These plans seem simple, but understanding their nuances is crucial before you commit.

How Gold Savings Schemes Work

Jewellers across Tamil Nadu design these schemes to attract regular buyers.

- You pay a fixed monthly amount.

- After a set period, usually 11 months, the jeweller adds a bonus installment.

- You can then use the total amount to buy gold jewellery.

However, the fine print matters. Not all plans are equal.

Example:

Pay ₹5,000 per month for 11 months → Total ₹55,000. Jeweller adds ₹5,000 bonus → Jewellery worth ₹60,000. But, if making charges are 10%, your final cost increases by ₹6,000, reducing the apparent benefit. For instance, for regulatory context on such schemes, you can refer to the Reserve Bank of India guidelines.

Benefits You Get

- Disciplined saving for jewellery purchases.

- Helps during wedding or festival seasons.

- Bonus installment acts as a small return on savings.

- Moreover, some plans protect against gold price fluctuations if they allow rate locking.

For more tips on buying gold wisely, see our guide on Gold Buying Tips for Malayalis.

What to Watch Closely

- Making Charges: Many plans cover only gold value. Extra making charges may apply.

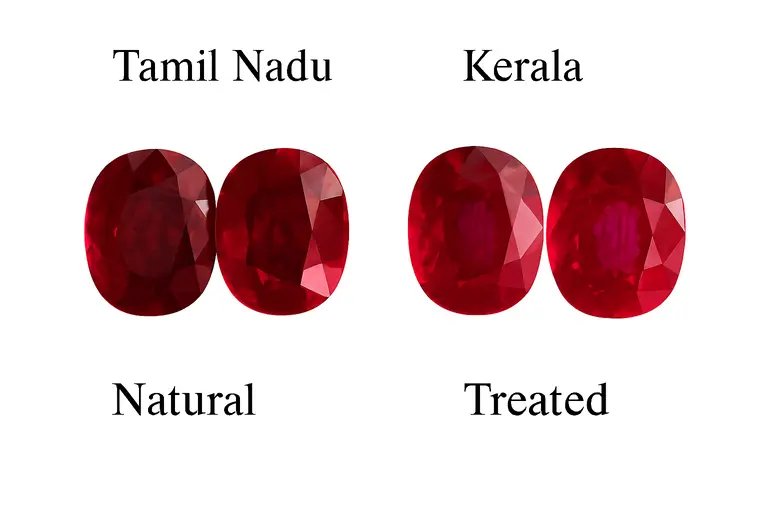

- Purity of Gold: Some schemes restrict purchases to 22K ornaments only.

- Time Limits: Missing installments may cause loss of bonus.

- No Cash Withdrawal: Savings can typically only be used for jewellery.

- Price Lock Conditions: Some plans fix the gold price monthly, others give prevailing rates at maturity.

Therefore, always read the terms before signing up.

Should You Join One?

Ask yourself:

- Will you buy jewellery soon?

- Are you okay with jewellery restrictions and making charges?

- Could bank RDs or mutual funds provide better returns?

In essence, these schemes suit buyers planning to purchase ornaments. Otherwise, for investment purposes, alternatives may yield higher returns.

FAQ

Q1. Can I withdraw cash from these schemes?

No. Most plans allow only jewellery purchases.

Q2. Are the schemes profitable?

Profit is limited; bonus installment helps, but making charges may offset gains.

Q3. Can I choose the purity of gold?

Many plans restrict purchases to 22K ornaments. Check with your jeweller.

Q4. Are gold savings schemes safe?

Yes, for saving to buy jewellery. They are not ideal as long-term investment options.