Introduction

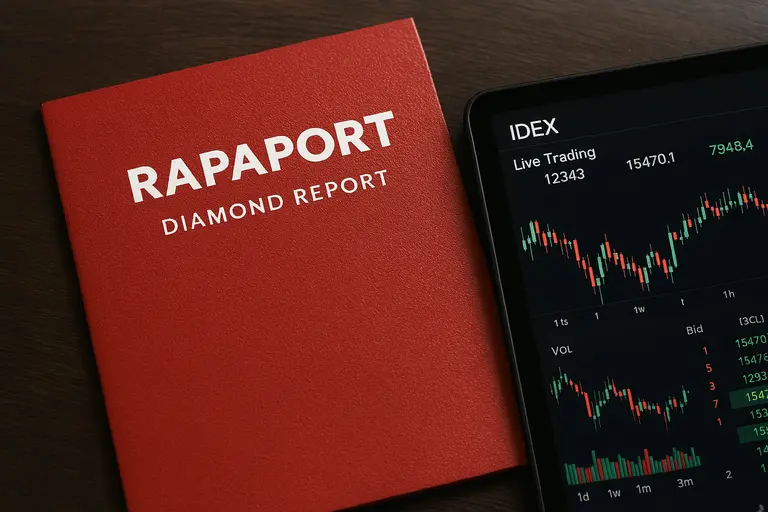

In the secretive world of diamond trading, knowledge is money. Most consumers walk into a jewelry store and accept the price tag on the ring. However, professional dealers operate on a completely different set of numbers. Rapaport vs IDEX Diamond Prices stand as the primary benchmarks in the industry. They compete as key references for wholesale pricing, dictating the value of billions of dollars in gems.

While dealer price lists cater to retail realities, these wholesale lists are the “True North.” These tools differ significantly, yet together they empower consumers—particularly in vibrant markets like Kerala and Mumbai—to secure fair deals. In this guide, I will unpack their unique features, contrasts, and how you can use them to negotiate like a pro. Ultimately, understanding the gap between “List Price” and “Cash Price” is the secret to buying smart.

What is the Rapaport Diamond Price List?

First and foremost, the Rapaport Diamond Price List, affectionately known as the “Rap Sheet,” represents the historical standard. Created by Martin Rapaport in the 1970s, it sets the “High Cash Asking Price.” It meticulously covers round brilliant and pear-shaped stones ranging from 0.01 to over 10 carats. Specifically, it categorizes them by color grades (D to Z) and clarity (IF to I3).

Dealers across the globe, including those in Kochi’s bustling jewelry hubs, rely on it as a foundational negotiation tool. For instance, a dealer might quote a stone at “20% Back” (20% discount below the list price). Moreover, this list updates every Thursday at midnight EST. It is accessible exclusively to subscribers through RapNet, the world’s largest B2B diamond marketplace. As a result, it directly influences international trade flows, from Antwerp vs Dubai Diamonds hubs to Mumbai’s polishing units.

Understanding the IDEX Online Price List

In sharp contrast, the IDEX Online Price List delivers transparency through technology. Unlike Rapaport, which is an “Opinion” of price, IDEX is based on Transaction Data. It captures the pulse of live wholesale market trends. IDEX’s Diamond Price Report analyzes asking prices for premium diamonds on a monthly and live basis.

Furthermore, as a direct competitor, IDEX emphasizes data transparency. While RapNet highlights its edge in inventory volume, IDEX highlights its edge in “Real-Time” accuracy. Therefore, forward-thinking jewelers often integrate IDEX insights to spot immediate shifts, such as post-festival price dips after Diwali or Onam. Overall, it serves as a vital complement, enabling quicker decisions in fast-moving trades. You can compare this to the traceability tech discussed in Future of Single Mine Origin Gold.

How Dealer Price Lists Differ Worldwide

However, the price you see in the showroom is different. Dealer price lists diverge markedly from these industry benchmarks. Why? Because they function as retail instruments. They incorporate substantial markups—typically 50% to 100% over wholesale.

This covers:

- Overhead: Rent, AC, Staff.

- Inventory Cost: Holding a diamond for a year costs money.

- Taxes: India’s GST and Import Duties (approx 2% + 5%).

For instance, a dealer in Kerala might elevate the price of a 1-carat G/VS2 diamond during wedding season. As such, these lists exhibit regional variations. Surat’s volume-focused wholesalers prioritize bulk discounts, while branded retailers layer on premiums for the brand name. Thus, they seldom align precisely with Rapaport vs IDEX Diamond Prices, emphasizing individual inventory realities. Read more about regional pricing in North vs South Indian Jewelry.

Key Differences: Rapaport vs IDEX Diamond Prices

To highlight the distinctions clearly, consider their core attributes side by side.

Rapaport

- Updates: Weekly (Thursdays).

- Basis: “High Cash Asking Price” (A ceiling price).

- Access: Subscription only (Trade).

- Role: The Anchor. It provides stability.

IDEX

- Updates: Real-time/Monthly.

- Basis: Actual Transaction Data (A trading price).

- Access: Platform users (Trade/Analysts).

- Role: The Current. It provides market fluidity.

Hence, most Indian dealers use Rapaport to set the price tag and check IDEX to see what the stone is actually selling for globally.

Consumer Benefits of Rapaport vs IDEX Diamond Prices

Importantly, these pricing benchmarks collectively promote unprecedented transparency. In India’s wedding-driven market, where diamond solitaires command premium attention, knowledge is power. Recognizing a deal at “15% off the Rap Sheet” equips buyers for effective negotiations in Ernakulam’s showrooms.

Additionally, they facilitate comparison shopping. For Kerala buyers who prioritize BIS Standard for Diamonds certified pieces, these tools safeguard against overpricing on stones with hidden flaws (like Strong Blue Fluorescence). In essence, mastering these resources maximizes value in India’s burgeoning diamond sector. If you want to avoid bad deals, check my Gemstone Buying Mistakes guide.

Conclusion on Rapaport vs IDEX Diamond Prices

In summary, the battle of Rapaport vs IDEX Diamond Prices is a win for the industry. It forces transparency. Ultimately, a diamond is a commodity. Its price should be based on global data, not just a jeweler’s whim. By understanding these lists, you move from being a “Customer” to being a “Client.”

FAQ: Rapaport vs IDEX Diamond Prices

What sets Rapaport vs IDEX Diamond Prices apart?

Rapaport furnishes structured weekly wholesale grids as a stable “Asking Price” reference. Conversely, IDEX supplies real-time insights based on live inventory data to capture swift market trends.

Can everyday consumers access Rapaport prices?

Generally, no. It requires a paid trade subscription and vetting. However, many educational sites and diamond forums leak the percentages or offer calculators based on the list.

Do Rapaport and IDEX cover fancy shapes?

Yes, but with caveats. Rapaport has a separate list for Pear shapes (which is used as a proxy for Ovals/Marquises). IDEX tracks fancy shapes based on inventory. The “Round Brilliant” list is always the primary standard.

Why do these lists hold special relevance for Indian buyers?

India polishes 90% of the world’s diamonds. Therefore, Indian prices are very sensitive to these lists. Understanding them helps buyers counteract local duties and seasonal wedding surges.

How do I use this to negotiate?

Ask the jeweler: “What is the discount off Rap?” (Rapaport). Even if you don’t have the list, asking the question signals that you know how the trade works, often leading to a better initial offer.

Author Bio

P.J. Joseph, also known as Saju Elizamma, Gemstone & Gold Consultant serving Kerala, Tamil Nadu, and Karnataka.