Introduction

For the first time in India’s rich jewelry history, jewelers face a unique existential challenge. In 2026, business owners must navigate a split path: Natural Diamonds (timeless gems formed deep in the earth) versus Lab-Grown Diamonds (factory-made replicas produced in weeks). While both sparkle identically to the naked eye, their value, rarity, and cultural significance differ vastly.

In India, where diamonds symbolize eternal love in weddings and festivals like Diwali, this confusion risks eroding customer trust. Can you sell both? My verdict is No. Jewelers cannot promote “Rare and Precious” alongside “Cheap and Abundant” without sending mixed messages. Therefore, choosing one path—Natural Diamonds Over Lab-Grown—ensures clarity, preserves heritage, and builds a sustainable business. In this article, I will explain why picking a side is the only way to survive the coming price crash.

The Dilemma: Natural Diamonds Over Lab-Grown

To begin with, Indian jewelers have long thrived on tradition. From the gem markets of Kottayam to the polishing hubs of Surat, the trade relies on the premise that jewelry is a store of value. However, Lab-Grown Diamonds (LGDs), imported cheaply from China, have flooded the market.

Customers, seeking affordable bridal jewelry, often mistake them for natural or assume they hold the same value. Selling both creates chaos. You celebrate natural rarity in an heirloom piece yet offer unlimited synthetics at the next counter. Moreover, this dilutes your brand. In a trust-driven market where families buy for generations, consistency is key. As a result, margins shrink, and jewelers compete on price alone—far from India’s luxury legacy.

Pricing of Natural Diamonds Over Lab-Grown

First, let’s look at the economics. Natural Diamonds operate like Real Estate or Gold. Supply is limited (mines are closing), so value tends to hold or rise over decades. In contrast, Lab-Grown Diamonds operate like Technology (Smartphones or TVs). Why? Because of “Moore’s Law.” Technology gets cheaper and faster every year.

For example, a 1-carat LGD that cost ₹1 Lakh in 2020 might cost ₹15,000 in 2026. Consequently, if you sell an LGD to a client today as an “asset,” you are selling them a depreciating liability. When that customer returns in 5 years to exchange it, and you tell them it is worth zero, you lose that customer forever. Read more about price trends in my Future of Lab-Grown Diamonds guide.

Trust Issues with Natural Diamonds Over Lab-Grown

Furthermore, customers rely on jewelers for honest advice. This is especially true during emotional buys like Mangalsutras or Engagement Rings. When you stock both, you imply they are identical except for price. However, this is a lie of omission.

Consider this scenario: A young couple buys an LGD ring from you. Five years later, they are wealthier and want to upgrade. They try to sell the ring, only to find it has no resale value. Thus, trust—the cornerstone of Indian retail—crumbles. Therefore, choosing Natural Diamonds Over Lab-Grown protects your reputation as a guardian of wealth. I discuss trust-building in my Jewelry Sales Secrets article.

The “Exchange” Culture of India

Additionally, India is unique. We have an “Exchange Culture.” Indian women view their jewelry box as a bank account. They expect to walk into a store and exchange old gold/diamonds for new designs. Natural Diamonds support this ecosystem. Most jewelers offer 80-90% buyback on naturals. Lab-Grown Diamonds break this ecosystem. You cannot offer a buyback on an item that drops 50% in value every year.

Consequently, if you shift to LGDs, you are exiting the “Asset Business” and entering the “Fashion Accessory Business.” You are competing with Zara, not Tanishq.

The 5 Pillars of Natural Diamonds

To thrive, Indian jewelers should rally around the Natural Diamond Story. Train your team to communicate these five pillars:

- Origin: Formed by the Earth 1-3 billion years ago. Authenticity resonates with India’s ancient gem lore.

- Rarity: Earth’s supply is finite. Synthetics are infinite. Rarity drives demand in high-end markets.

- Value: Naturals retain worth. They are a “Store of Wealth.”

- Sustainability: While labs claim to be green, they use massive amounts of electricity. Natural mining supports millions of livelihoods in Africa and India.

- Meaning: A diamond is special because it is rare. If everyone has a 5-carat stone, it is no longer special.

By adopting these, jewelers unite, boosting credibility. Ensure you follow the new labeling rules I discussed in the BIS Standard for Diamonds.

Conclusion on Natural Diamonds Over Lab-Grown

Ultimately, India’s jewelry sector stands at a crossroads. Choose clarity over confusion. Choose tradition over imitation. Natural Diamonds Over Lab-Grown is not just a slogan; it is a survival strategy for the independent jeweler.

In summary, let the fashion brands sell the factory stones. You should sell the miracles of nature. Your business—and India’s gem legacy—will flourish if you stay true to value.

FAQ: Natural vs Lab-Grown Business

Are lab-grown diamonds eco-friendlier than natural ones?

Not necessarily. The myth persists, but lab production uses massive electricity (often coal-powered in China) to run the reactors. In contrast, natural mining companies are heavily regulated and invest in biodiversity.

Can Indian jewelers profit from lab-grown diamonds?

Short-term, yes. The margins are high today. However, as prices crash, your inventory value vanishes. Natural diamonds offer stable margins and long-term asset value for your stock.

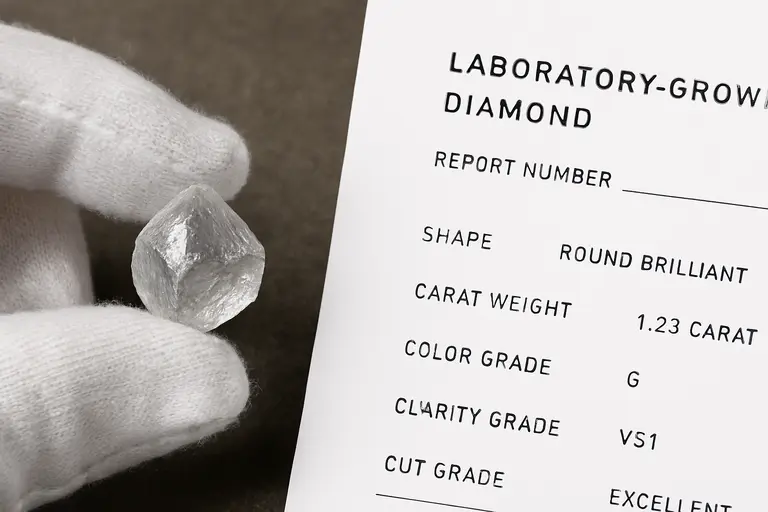

How do I disclose diamond types legally?

Strict adherence to the BIS Standard is mandatory. Abbreviations like “LGD” or “Lab Dia” are now prohibited on invoices. Instead, jewelers are required to write “Laboratory-Grown Diamond” in full to ensure transparency and build trust.

What is the resale value difference?

Huge. Natural diamonds typically hold 50-80% of their value for exchange. Lab-grown diamonds currently have near-zero resale value in the secondary market.

Should small Kerala jewelers go natural-only?

Absolutely. Your competitive advantage against big chains and online stores is Trust. Selling a product that retains value (Natural) reinforces that trust.

Author Bio

P.J. Joseph, also known as Saju Elizamma, Gemstone & Gold Consultant serving Kerala, Tamil Nadu, and Karnataka.

Credits

This article draws on reporting originally published by Instore Magazine.

Credit to Fred Mouawad of the Instore Magazine (SmartWork Media) for first sharing Why Jewelers Can’t Sell Both Natural and Lab-Grown Diamonds.

This story is adapted from Instore Magazine, a trade publication dedicated to helping independent retailers improve their businesses in the USA, with additional SEO and contextual research by Saju Elizamma.