Summary

Gold buyers in Kerala often find their jewellery bills confusing. This article breaks down the three major components — making charges (Pani Kuli), wastage (Thattam), and GST. Learn what each term means, how these charges are calculated, and where you can negotiate to save money on your next gold purchase.

Kerala Jeweller’s Bill Explained

When you buy gold in Kerala, your bill includes more than the metal’s market price.

It’s usually made up of three main parts:

- Pani Kuli (Making Charges)

- Thattam (Wastage)

- GST (Goods and Services Tax)

Understanding these will help you read your jeweller’s bill correctly and negotiate better. If you’re new to gold buying, read our related post — Gold Purity 101: What Do Karats and Hallmarking Really Mean in Kerala — before you start shopping.

1. Pani Kuli – Making Charges

Pani Kuli represents the labour cost for crafting your ornament.

Most jewellers charge it as a percentage of the gold price.

Example:

If gold costs ₹5,000 per gram and the making charge is 10%, you’ll pay ₹500 extra per gram.

However, some shops charge a flat rate per gram instead of a percentage. Always ask your jeweller which method they use.

Tip:

Making charges are negotiable. For larger purchases or repeat customers, many Kerala jewellers are open to lowering this rate.

2. Thattam – Wastage

Thattam covers the small amount of gold lost during melting, shaping, cutting, and polishing. The percentage depends on the design and workmanship.

- Simple bangles or chains: 3–5% wastage

- Intricate necklaces or antique pieces: 10–12% wastage

Different jewellers may quote different wastage rates for the same design. That’s why it’s wise to compare quotes before you buy.

To confirm the gold’s purity, check for the BIS hallmark. For reference, visit the official BIS Hallmarking Guidelines.

3. GST on Gold Jewellery

GST is fixed at 3% on the final invoice amount, which includes the gold cost, making charges, and wastage.

It’s a non-negotiable tax that applies to all gold jewellery purchases across India.

Even though you can’t avoid it, you can verify the correct GST calculation by asking for a detailed tax breakup on your bill.

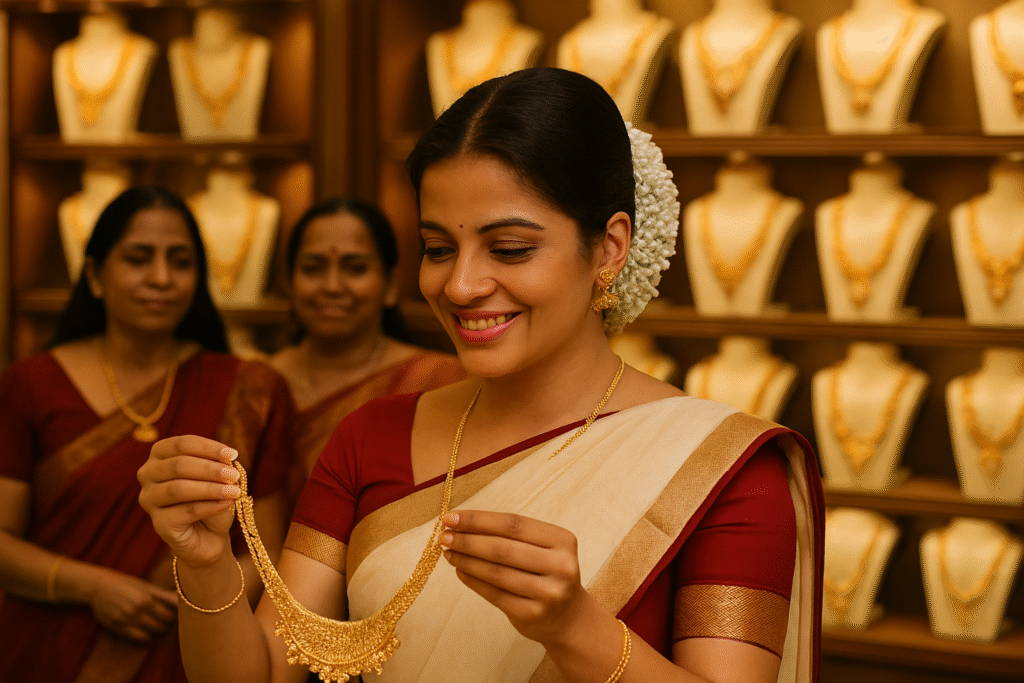

How to Save on Your Gold Purchase

- Negotiate the making charges and wastage — not GST.

- Compare multiple jewellers before finalising your order.

- Request a clear, itemised bill that lists all charges separately.

- Verify purity through BIS hallmarking and authorised certification.

When you understand these details, you gain control over your gold purchase and ensure full transparency from your jeweller.

FAQ

1. Are making charges the same at all jewellery shops in Kerala?

No. They vary from shop to shop, depending on design complexity and labour effort. Always compare before buying.

2. What is the average wastage rate for lightweight jewellery?

It’s usually between 3% and 5%, depending on the type of ornament.

3. Is GST applied only to the gold value?

No. GST is charged on the total bill, including gold cost, making charges, and wastage.

4. How can I confirm the authenticity of my gold purchase?

Look for the BIS hallmark stamp and read our guide — Understanding BIS Hallmark: What It Means for Your Jewellery.

5. Why do different jewellers quote different prices for similar designs?

Because their making charges and wastage rates differ. Comparing bills helps you find the best value.