Understand how jewellers in Kerala calculate gold bills. Learn about making charges (Pani Kuli), wastage (Thattam), and GST. Find out how to negotiate and save on your gold purchase.

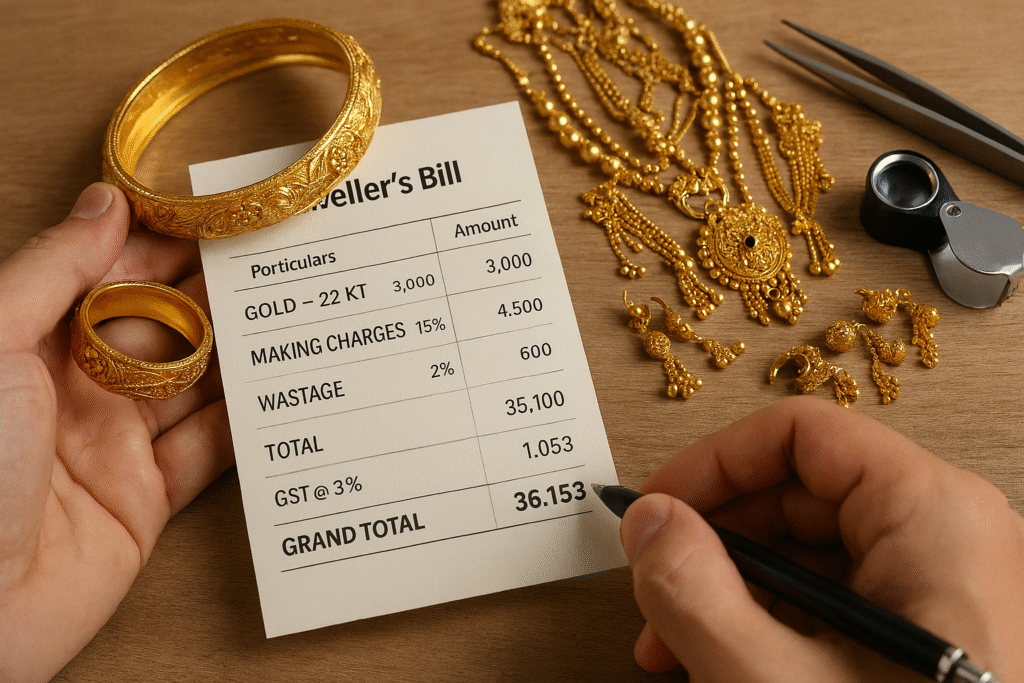

Decoding the Jeweller’s Bill in Kerala

When you buy gold in Kerala, the bill has more than just the price of gold.

Three key items often confuse buyers:

- Pani Kuli (Making Charges)

- Thattam (Wastage)

- GST

Let’s break them down.

1. Pani Kuli – Making Charges

- This is the labour cost for crafting your jewellery.

- It is usually a percentage of the gold price.

- Example: If gold costs ₹5,000 per gram, and the making charge is 10%, you pay ₹500 extra per gram.

- Some jewellers may quote a flat rate per gram instead.

Tip for you:

Making charges are negotiable. Always ask if the jeweller can reduce the rate.

2. Thattam – Wastage

- This covers the gold lost during melting, cutting, or polishing.

- The rate varies depending on the design.

- Simple bangles may have 3–5% wastage.

- Intricate necklaces may go up to 10–12%.

Question for you:

Did you know that two shops may quote different wastage for the same design? Always compare before buying.

3. GST on Gold Jewellery

- GST is fixed at 3% on the final bill.

- This applies after adding gold price, making charges, and wastage.

- Unlike other charges, GST cannot be negotiated.

Key Takeaways for You

- Focus your negotiation on making charges and wastage.

- Compare bills from multiple jewellers before finalising.

- Ask the shop to show a clear breakup of all charges.

When you understand the bill, you have more control over your purchase.